Income tax estimator 2020

Ad 2020 Federal Tax Filing 100 Free IRS 2020 Taxes. If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied.

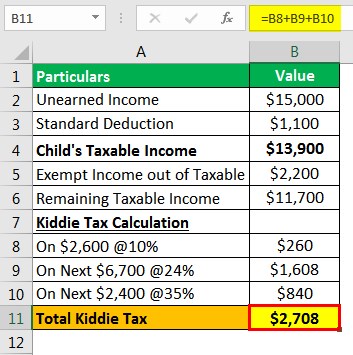

Kiddie Tax Meaning Example How To Calculate

The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability for tax year 2020.

. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. To change your tax withholding amount. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

Ask your employer if they use an automated system to submit Form W-4. Or keep the same amount. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Seattle Washington vs Fawn Creek Kansas. It is mainly intended for residents of the US.

HR Block does not provide audit attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Effective tax rate 172. Estimate your tax refund with TaxCaster our free tax calculator that stays up to date on the latest tax laws.

Submit or give Form W-4 to. Filing Is Easy With TurboTax. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and Taxes with details on state and local sales income property and automobile taxes - Includes the cost of Child Care for toddlers or infants at a day.

A salary of 50000 in Seattle Washington could decrease to 16716 in Fawn Creek Kansas assumptions include Homeowner no Child Care and Taxes are not considered. Include your income deductions and credits to calculate. Start with the 2021 Tax Calculator - TAXstimator- and estimate your 2022 Tax Refund or Tax Return results.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Use any of these 10 easy to use Tax Preparation Tools.

Mark Your 2020 Taxes Off Your List Today. Based on aggregated sales data for all tax year 2020 TurboTax products. As announced in the 202223 federal Budget the low and middle income tax offset has been increased by 420 for the 202122 income year.

Offer valid for returns filed 512020 - 5312020. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The base amount for the 202122 income year has increased to 675 and the full amount is 1500.

Your household income location filing status and number of personal exemptions. The 2022 tax values can be used for 1040-ES estimation planning ahead or. E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025 Visit site Your Online Account Internal Revenue Service - IRS tax.

0 Federal 1799 State. After You Use the Estimator. And is based on the tax brackets of 2021 and 2022.

Use the PriorTax 2020 tax calculator to find out your IRS tax refund or tax due amount. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. 2022 Cost of Living Calculator. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online.

Quickly Prepare Your 2020 Tax Return. If your taxable income is less than 126000 you will get some or all of the low and middle income tax offset. Use your income filing status deductions credits to accurately estimate the taxes.

Americas 1 tax preparation provider. Use your estimate to change your tax withholding amount on Form W-4. Your household income location filing status and number of personal exemptions.

Coronavirus Aid Relief and Economic Security CARES Act permits self-employed individuals making estimated tax payments to defer the payment of 50 of the social security tax on net earnings from self-employment imposed for the period beginning on March 27 2020 and ending December 31 2020. Our Premium Calculator Includes. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Click here to customize. 2020 Individual Income Tax Estimator. File Your 2020 Income Fast.

Then get your Refund Anticipation date or Tax Refund Money in the Bank Date. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

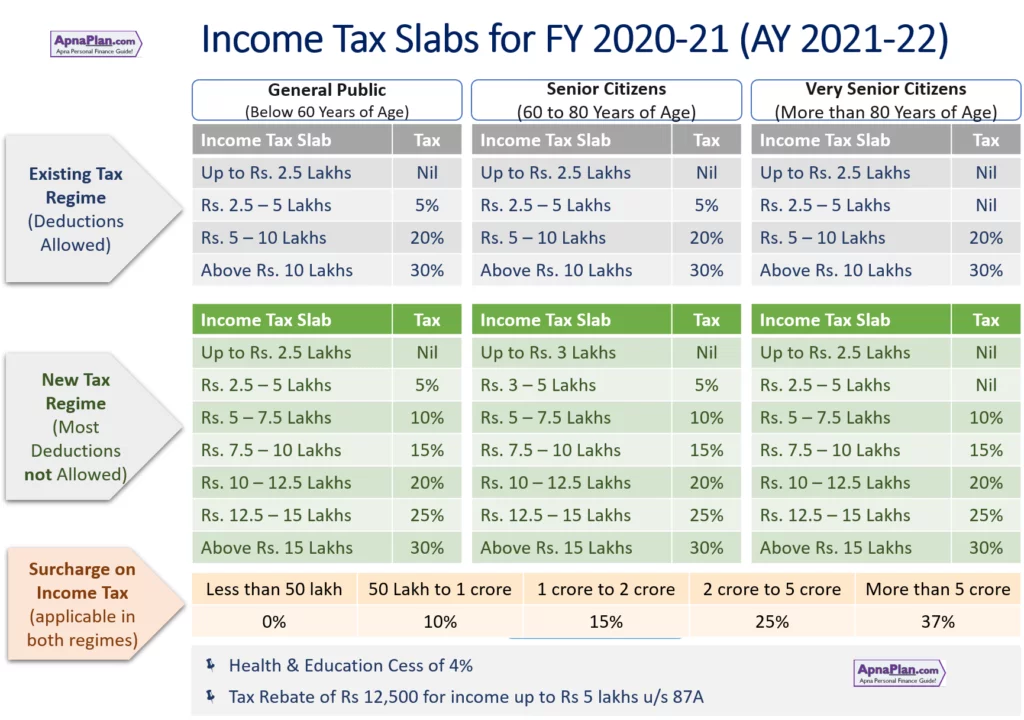

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Australian Tax Calculator Excel Spreadsheet 2022 Atotaxrates Info

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Inkwiry Federal Income Tax Brackets

How Is Taxable Income Calculated How To Calculate Tax Liability

How To Calculate Federal Income Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Tax Rate Calculator Top Sellers 55 Off Www Ingeniovirtual Com

2020 Income Tax Calculator Deals 56 Off Www Ingeniovirtual Com

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Calculate Income Tax In Excel How To Calculate Income Tax In Excel